Investor Deck

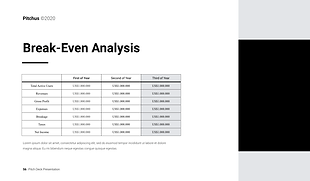

Break-even Analysis

This section details the break-even analysis, showing when the startup expects to cover all its costs with its revenue, reaching a financial balance. It includes calculations of fixed and variable costs, pricing, and projected sales volumes.

SECTION

Financials (Critical for Investment)

IMPORTANCE

8

/10

Break-even analysis is crucial for investors as it provides a clear indicator of when the startup will become financially self-sustaining. It highlights the sales volume required to cover costs, giving insights into the company's financial risks and operational leverage.

WHAT SHOULD BE INCLUDED:

Fixed Costs: Costs that do not change with the level of output, such as rent, salaries, and utilities.

Variable Costs: Costs that vary directly with the level of production or sales, such as materials and direct labor.

Revenue Per Unit: The price at which the product or service is sold.

Break-even Point: The number of units that must be sold to cover all costs (calculated as Fixed Costs / (Revenue Per Unit - Variable Cost Per Unit)).

TIPS

Clarity in Calculations: Clearly outline how the break-even point is calculated, ensuring transparency in your assumptions and methodology.

Scenario Analysis: Provide different scenarios based on various sales volumes and pricing strategies to show how changes might impact the break-even point.

Graphical Representation: Use charts or graphs to visually represent the break-even analysis, making it easier for investors to grasp the concept and data.

EXAMPLES

A startup in the manufacturing sector: Can illustrate how adjustments in production scale or material costs directly influence their break-even point, aiding strategic decisions about scaling operations.

A tech company offering SaaS products: Might show how increasing subscription prices or reducing cloud hosting costs could lower the break-even threshold, making the business profitable sooner.

A restaurant chain: Could demonstrate the impact of varying customer footfall and average spending per customer on reaching its financial equilibrium.